The Social Security Administration Form SSA-44 is a vital form for those who are receiving Social Security benefits or who are applying for them. It is a formal request for a new or replacement Social Security card, and is used to verify information about an individual. In this article, we’ll look at the basics of Form SSA-44, including what it is, why it’s important, and how to fill it out.

All You Need to Know About the Social Security Form SSA-44

What is the SSA-44 Form?

The SSA-44 is an essential document for individuals and businesses who are looking to receive Supplemental Security Income (SSI). This form is used to provide evidence of your financial eligibility in order to qualify for SSI benefits. The form is intended to provide information regarding your assets, income, and any other sources of income. Additionally, it is used to verify the identity of the applicant.

The SSA-44 is a four-page document which contains detailed questions to be answered by the applicant. The questions are designed to ensure that the information is provided accurately. The form requires details such as the name of the applicant, their address, Social Security Number, and any other sources of income. Additionally, the form will require details about the applicant’s assets such as bank accounts, investments, and other financial information. The SSA-44 must be completed and signed in order for the applicant to qualify for SSI benefits.

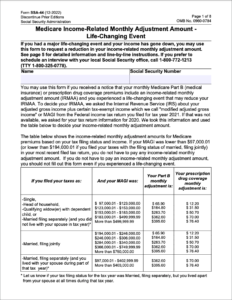

Can I use the SSA-44 to appeal medicare income-related monthly adjustment amount / premiums and get a reduction?

The SSA-44 is not used to appeal Medicare premiums or to receive a reduction. However, it can be used to provide information that may qualify you for a lower premium. For example, if you are a retired individual or have a disability, you may qualify for a reduced premium. Additionally, if you have limited resources, you may be able to receive a reduction. It is important to note that the SSA-44 form is not required in order to appeal medicare premiums or to receive a reduction.

It is important to understand the importance of the SSA-44 form and the information it requires in order to receive Social Security benefits. By understanding the form and the information it requires, you will be better prepared to make an informed decision about your Social Security benefits. Additionally, it is important to understand the process of appealing medicare premiums in order to receive a reduction.

Who Needs to Fill Out the SSA-44 Form?

The SSA-44 form is for anyone who is applying for or receiving Supplemental Security Income (SSI). This includes those who are applying for Social Security Disability Insurance (SSDI). Additionally, those who are applying for or receiving Medicaid, Medicare, or other welfare programs may need to complete the SSA-44 form. It is also required for individuals who are applying for a new or replacement Social Security card.

Eligibility Requirements

In order to be eligible for SSI benefits, applicants must meet the financial eligibility requirements. This includes having limited assets and income. Applicants must provide proof of their income and assets on the SSA-44 form. Additionally, their income must fall below the poverty line in order for them to receive SSI benefits.

How to Fill Out the SSA-44 Form

Filling out the SSA-44 form can seem like an intimidating task, but it is actually quite simple. The form is designed to walk applicants through the process step-by-step. To begin, applicants should provide their full name, Social Security Number, and any other relevant information. This includes their address, date of birth, and any other contact information. Then, the form will require the applicant to provide information regarding their assets and any other sources of income. This includes bank accounts, investments, and other financial information. Finally, the form must be signed and dated in order to be submitted.||Submitting the SSA-44 Form

Once the SSA-44 form is completed and signed, it can be sent to the Social Security Administration for processing. The form can be mailed or delivered in person. It is important to note that it can take up to six weeks for the form to be processed, so it’s important to be patient. Additionally, it is important to keep a copy of the form for your records in case you need to reference it in the future.

What Information is Required on the Form?

The SSA-44 form requires applicants to provide a variety of information. This includes information regarding their name, address, date of birth, and Social Security Number. Additionally, applicants must provide proof of their income and assets in order for them to be considered for SSI benefits. This includes bank accounts, investments, and any other financial information. The form must also be signed and dated in order to be submitted.

How to Complete the Form

The SSA-44 form is relatively straightforward and is designed to walk applicants through the process step-by-step. To begin, applicants should provide their basic information, such as their full name, Social Security Number, address, and date of birth. Then, they must provide information regarding their assets and any other sources of income, such as bank accounts and investments. Finally, the form must be signed and dated in order to be submitted.

Tips

In order to streamline the process, it is important to have all the required information ready when filling out the SSA-44 form. This includes proof of income and asset information. Additionally, it is important to keep a copy of the form for your records. Finally, it can take up to six weeks for the form to be processed, so it’s important to be patient.

Where to download SSA-44 form

Where to Submit the SSA-44 Form

Once the SSA-44 form is completed and signed, it can be sent to the Social Security Administration for processing. The form can be mailed or delivered in person. Additionally, it is important to keep a copy of the form for your records in case you need to reference it in the future.

Where to Submit the SSA-44 Form Online

Applicants can also submit the SSA-44 form online. This can be done by creating an account on the Social Security Administration’s website and entering the required information. Please note that this process may take longer to process than submitting the form via mail or in person.

Where to Submit the SSA-44 Form By Mail

If applicants choose to submit their SSA-44 form via mail, they should send the form to the Social Security Administration’s mailing address found on the form. It is important to include a self-addressed stamped envelope in order to receive a response. Additionally, it is important to keep a copy of the form for records.

Where to Submit the SSA-44 Form In Person

Lastly, applicants can submit their SSA-44 form in person at any Social Security Administration office. Applicants should bring a copy of the form, as well as proof of identification and income information. It is important to keep a copy of the form for records.

Deadlines for Submitting the SSA-44 Form

It is important to submit the SSA-44 form as soon as possible in order to avoid any delays in processing. The Social Security Administration typically takes up to six weeks to process the form, however, this timeline may be extended during peak periods.

Does Form SSA-44 need to be notarized?

No, Form SSA-44 does not need to be notarized. According to the Social Security Administration (SSA), an original signature is sufficient to prove identity and authority when filing Form SSA-44. However, it is recommended to keep a copy of the form for your own records.

Is there a fee associated with submitting Form SSA-44?

No, there is no fee associated with submitting Form SSA-44. The form is available online, and you can also request a paper copy from the Social Security Administration. After completing the form, you can submit it either online or via mail.

Learn More About the Certification

Interested in learning more about how to navigate this information and integrate it into your practice?

Who is IRMAA Certified Planner?

IRMAA Certified Planner was created to help educate financial professionals about the concepts, rules and regulations surrounding Medicare’s IRMAA. With industry leading research and tools, we are committed to educating and certifying each individual that works through us, has the most up to date information to help their clients plan and prosper.

Streamlining the Medicare Surcharge Calculation Process.

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.